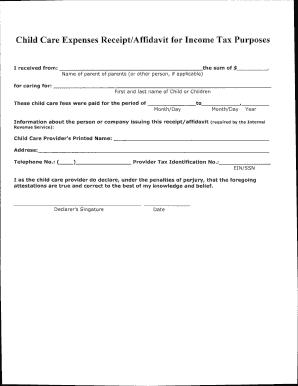

Child Care Year End Receipt for Parents free printable template

Show details

1 – 2 – 3 Learn Curricula. Child Care Year End Receipt for Parents. You have the 2 options when using this year-end receipt for parents form: 1. Print up form ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign daycare tax form parents printable

Edit your create child care receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your daycare tax forms printable printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit printable daycare tax forms for parents online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit daycare end of year receipt form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

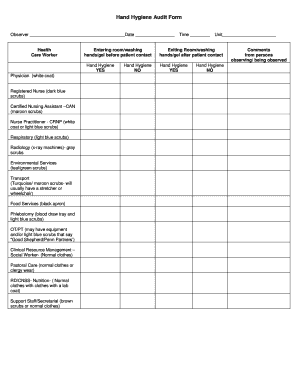

How to fill out daycare tax form

How to fill out Child Care Year End Receipt for Parents

01

Gather all attendance records for the year.

02

Calculate the total number of days the child attended care.

03

Determine the total amount of fees paid by the parents for child care services.

04

Fill out the child's name, the provider's name, and the tax year on the receipt.

05

List all expenses categorized under the relevant headings such as tuition, meals, and supplies.

06

Include the provider's tax identification number (TIN) for tax purposes.

07

Sign and date the receipt.

08

Provide a copy to the parents for their records.

Who needs Child Care Year End Receipt for Parents?

01

Parents who have utilized child care services for their children.

02

Parents needing to claim child care expenses on their tax returns.

03

Child care providers who wish to issue formal documentation for the services rendered.

Fill

in home daycare tax form

: Try Risk Free

People Also Ask about daycare tax statement pdf

Who is eligible for Form 2441?

If you hire someone to care for a dependent or your disabled spouse, and you report income from employment or self-employment on your tax return, you may be able to take the credit for child and dependent care expenses on Form 2441.

Does the IRS ask for proof of child care expenses?

You need to be able to verify childcare expenses in case of an audit. If you don't have proof that you paid these expenses, you can't claim the credit. You don't have to bring the receipts to your tax pro or mail them with your return.

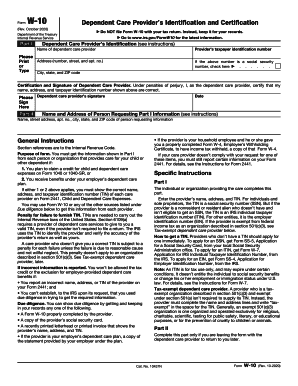

How do I prove childcare to the IRS?

To identify the care provider, you must give the provider's name, address, and taxpayer identification number (TIN). You can use Form W-10, Dependent Care Provider's Identification and Certification, to request this information.

How does IRS verify child tax credit?

To prove: The IRS generally wants one or more documents that show the name of the child, the address you used on your tax return, AND the year that the audit is for. Any "official" document will work as long as it shows these three things. For example, a lease, a school record, or a benefits statement.

Does the IRS verify child care expenses?

Verifying Fees and Records If the day-care provider uses contracts, he must provide a copy of the contracts to the auditor. As a child-care provider, the IRS will ask you what fees you charge if a parent drops off a child early or picks him up late. The auditor will want to know about any other special fees you charge.

What is the income limit for Form 2441 in 2021?

For 2021, the maximum amount is increased to $10,500 (previously $5,000). For married employees filing separate returns, the maximum amount is increased to $5,250 (previously $2,500).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my daycare tax statement directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your daycare tax form for parents as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get printable daycare tax form for parents?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific end of year daycare receipt and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete tax statement for child care online?

pdfFiller has made it easy to fill out and sign printable daycare year end tax statement. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

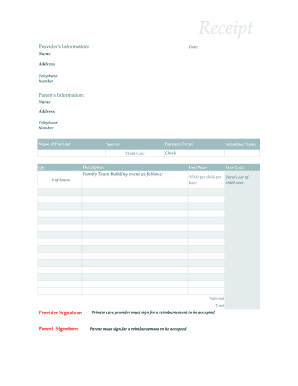

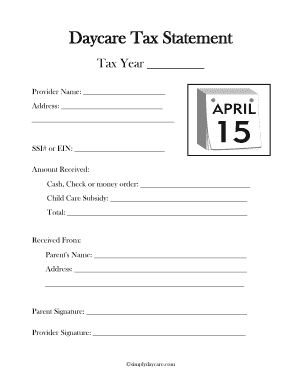

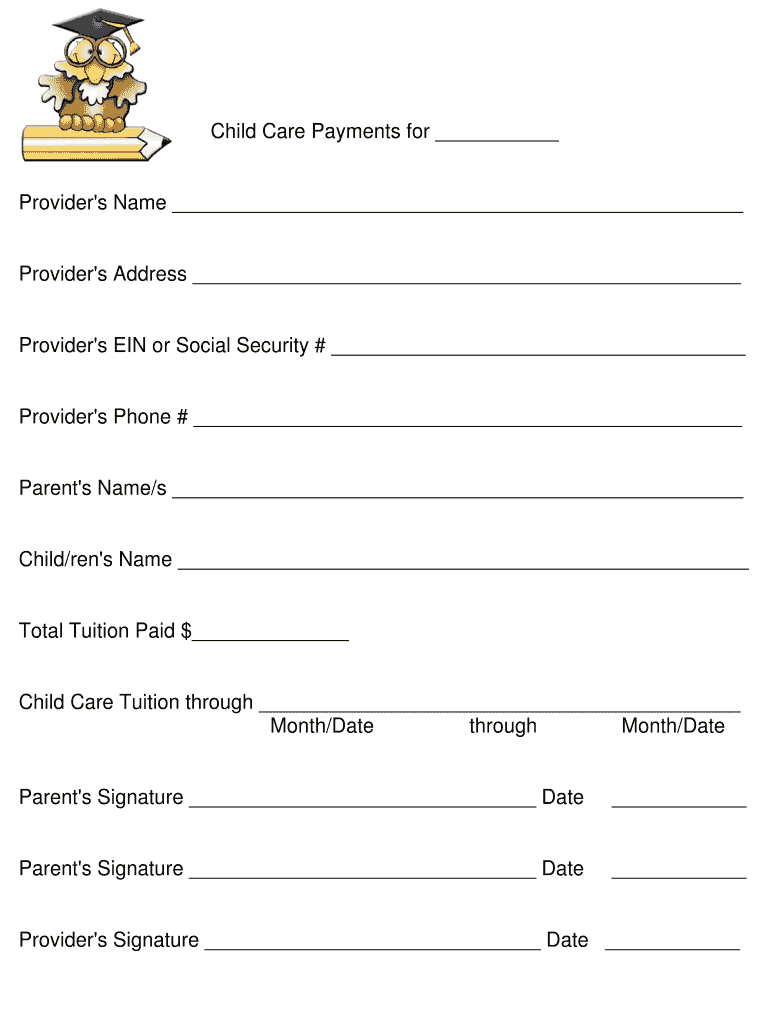

What is Child Care Year End Receipt for Parents?

The Child Care Year End Receipt for Parents is a document provided by childcare providers that summarizes the total amount paid by parents for childcare services over the year, which can be used for tax purposes.

Who is required to file Child Care Year End Receipt for Parents?

Parents who utilize childcare services and wish to claim childcare expenses on their taxes are required to file the Child Care Year End Receipt for Parents.

How to fill out Child Care Year End Receipt for Parents?

To fill out the Child Care Year End Receipt, parents need to provide their name, address, and Social Security number, along with details of the childcare provider and the total amount paid for childcare over the year.

What is the purpose of Child Care Year End Receipt for Parents?

The purpose of the Child Care Year End Receipt for Parents is to provide documentation needed for tax deductions or credits related to childcare expenses.

What information must be reported on Child Care Year End Receipt for Parents?

The Child Care Year End Receipt must include the parent's name, address, provider's name, provider's Tax ID or Social Security number, service dates, and the total amount paid for childcare during the year.

Fill out your Child Care Year End Receipt for Parents online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Care Tax Receipt is not the form you're looking for?Search for another form here.

Keywords relevant to daycare form for taxes

Related to end year statement daycare

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.